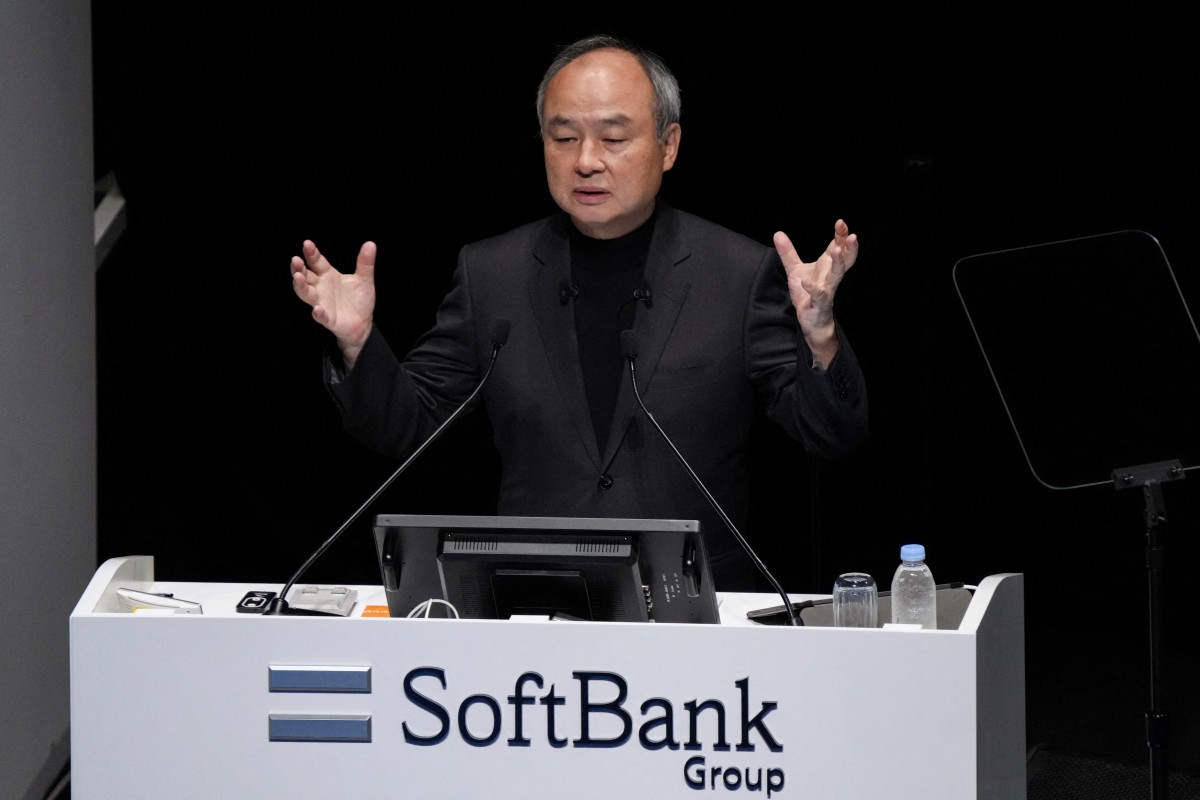

SoftBank Group’s shares fell sharply on Tuesday, wiping nearly $5 billion from founder and CEO Masayoshi Son’s fortune, as excitement around Google’s new Gemini 3 artificial intelligence model raised concerns about the investment giant’s heavy bet on OpenAI, the maker of ChatGPT.

Key Facts

SoftBank shares dropped nearly 11% on Tuesday before recovering slightly to ¥15,390 ($98.5), down 9.95% from the previous close.

The decline follows a 10.9% fall in the company’s shares on Friday when the Tokyo Stock Exchange reopened after a long weekend.

The stock drop comes amid worries about increasing competition for OpenAI, in which SoftBank’s Vision Fund has invested heavily.

Concerns about OpenAI’s market dominance surfaced after Google released its new Gemini 3 model, which received strong reviews.

Earlier this month, SoftBank announced it had sold its entire 32.1 million share holding in Nvidia in October for $5.83 billion to fund other AI investments, including OpenAI.

Forbes Valuation

According to estimates, Masayoshi Son’s net worth fell by $4.9 billion to $49.3 billion on Tuesday as SoftBank shares hit their lowest level since mid-September. His ranking on Forbes’ Real Time Billionaires list dropped to 32nd in the world. Son, who was Asia’s third richest person at the beginning of the month, now ranks eighth in the region, just below Uniqlo founder and CEO Tadashi Yanai.

Google’s Recent AI Success

Google’s shares rose 4.16% to $331.33 in premarket trading on Tuesday, fueled by optimism about its AI business. The company released Gemini 3 last week, which outperformed AI models from OpenAI and Anthropic on several benchmarks. The new chatbot received praise for its creative writing capabilities and its Nano Banana Pro image generator. Salesforce CEO Marc Benioff commented that after spending time with Gemini 3, he would no longer use ChatGPT. Even OpenAI CEO Sam Altman and xAI CEO Elon Musk congratulated Google on the successful launch.

Impact on Other Companies

Google’s successful launch of Gemini 3 also affected other companies. Nvidia’s shares fell 4% to $175.17 in premarket trading after reports that Meta, Facebook’s parent company, is in discussions to acquire Google’s AI chips, known as Tensor Processing Units (TPUs). Unlike many competitors that rely on Nvidia’s GPUs, Google trained Gemini 3 on its custom TPUs. While GPUs were originally designed for 3D graphics but adapted for AI training, TPUs are built specifically for AI and are considered more efficient.