Shifting markets and geopolitical turbulence marked 2025, significantly reshaping the fortunes of Arab billionaires. Volatile energy prices, global economic uncertainty, and regional developments created both opportunities and setbacks, producing clear winners and losers over the year.

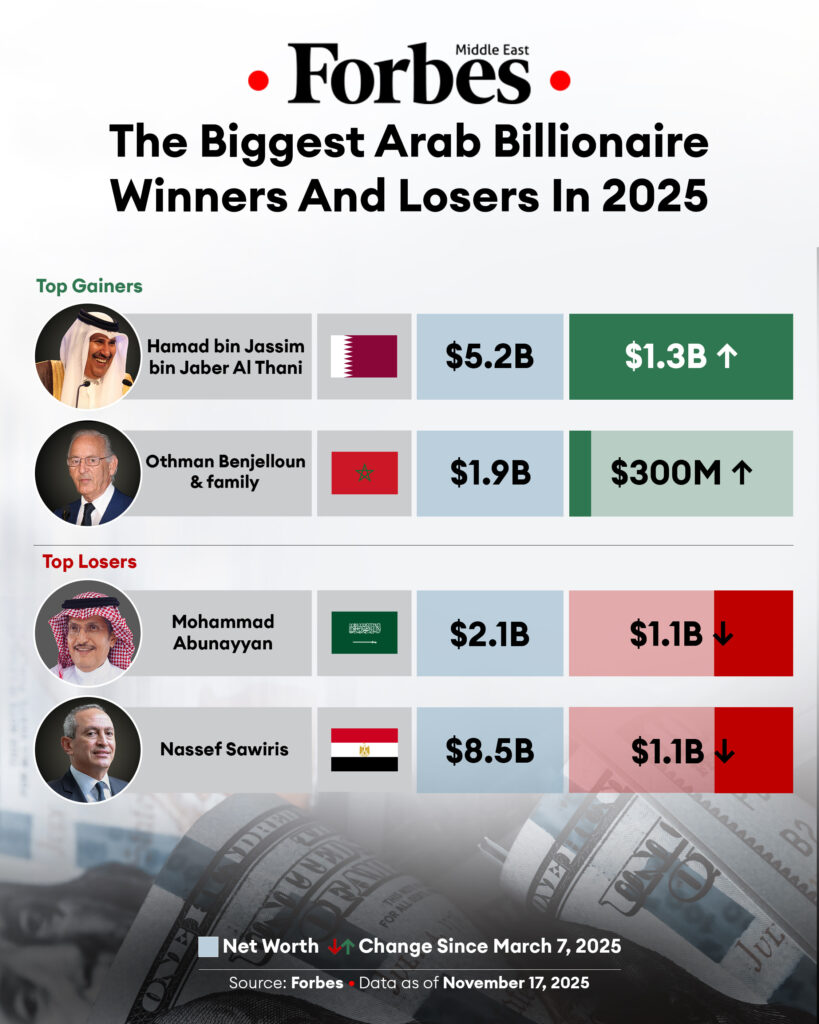

Top Gainers

Hamad bin Jassim bin Jaber Al Thani

Increase: $1.3 billion

Net worth: $5.2 billion

Citizenship: Qatari

Al Thani served as Qatar’s prime minister from 2007 to 2013 and as foreign minister from 1992 to 2013. His great-uncle founded modern Qatar in 1971, and he is a cousin of the country’s current Emir. Al Thani holds a 3% stake in Deutsche Bank through Paramount Services Holdings, making it his largest publicly listed investment. Deutsche Bank’s share price has risen 39.5% since March 7, 2025, reaching $35.7 by November 17. The bank also reported a strong financial performance, with net profits for the first nine months of 2025 jumping 75% year-on-year to $6.5 billion.

Othman Benjelloun & Family

Increase: $300 million

Net worth: $1.9 billion

Citizenship: Moroccan

Othman Benjelloun, Morocco’s wealthiest individual, is the chairman and chief executive of Bank of Africa BMCE Group, which operates across 32 countries, including 20 in Africa. As of June 2025, the group employed 15,000 people and served 6.6 million customers. Its consolidated net banking income rose 8% year-on-year in the first half of 2025 to $1.1 billion, driven by growth in core operations, with net interest income up 8% and fee income increasing 2.3%. Income from market operations surged 54.2% over the same period. Through his holding company FinanceCom, Benjelloun also owns a stake in the Moroccan unit of French telecom operator Orange.

Top Losers

Mohammad Abunayyan

Decrease: $1.1 billion

Net worth: $2.1 billion

Citizenship: Saudi

Abunayyan is the founder and chairman of ACWA Power, a Saudi-based company focused on power generation and water desalination. He established the firm in 2004 and listed it on the Saudi Exchange in 2021. Abunayyan holds a direct 3.5% stake in the company, while the Public Investment Fund owns 44.2%. ACWA Power’s share price fell 37.5% between March 6 and November 17, 2025, reaching $57. The decline followed weaker financial performance, with the company reporting third-quarter 2025 revenues of $442.5 million, down 5% year-on-year for the July–September period.

Beyond ACWA Power, Abunayyan serves as chairman of Vision Invest, a Saudi holding company with interests in both public and private businesses. He also owns an 8% stake in Abdullah Abunayyan Trading Company, which in turn holds a 50% stake in Vision Invest.

Nassef Sawiris

Decrease: $1.1 billion

Net worth: $8.5 billion

Citizenship: Egyptian

Sawiris, Egypt’s richest individual, saw his net worth decline by $1.1 billion over an eight-month period, falling to $8.5 billion as of November 17, 2025. He serves as executive chair of OCI Global, one of the world’s largest nitrogen fertilizer producers, with manufacturing facilities in Texas and Iowa and a listing on Euronext Amsterdam. OCI’s share price dropped 19.4% between March 7 and November 17, 2025, to $4, reducing the company’s market capitalization to $839.5 million. In 2024, ADNOC acquired OCI’s stake in Fertiglobe for $3.62 billion.

Sawiris also holds close to a 6% stake in German sportswear group adidas. The company’s shares declined 32.3% over the same period, reaching $185.7 on November 17, 2025, and lowering its market value to $33.4 billion. In addition, Sawiris has been a co-owner of English football club Aston Villa since 2018, alongside Wes Edens, cofounder of Fortress Investment Group.